Florida homeowners face a harsh reality after hurricane damage. Their standard homeowner’s insurance covers wind damage but not flooding. Many Fort Lauderdale property damage lawyers spend time explaining this difference to their confused clients. This major gap in coverage leaves property owners exposed when severe weather hits.

Insurance companies look hard to cut down or deny claims after disasters strike. Smart property owners should never accept an insurer’s first offer on property damage claims in Fort Lauderdale. Fort Lauderdale property damage attorneys know these tactics well and help direct clients through the complex claims process. Property owners who work with a Fort Lauderdale hurricane property claim lawyer usually get substantially higher payouts than those who go it alone.

Florida’s flood insurance claims need specialized knowledge that commercial property damage lawyers in Fort Lauderdale provide effectively. The outcome between fair compensation and financial hardship often depends on knowing what insurance companies keep hidden. This applies to hurricane damage, flood problems, or any other property destruction.

Table of Contents

- 1 When Should You Call a Property Damage Lawyer in Fort Lauderdale?

- 2 Common Types of Property Damage in Fort Lauderdale

- 3 Why Insurance Companies Deny or Undervalue Claims

- 4 How a Fort Lauderdale Property Damage Lawyer Can Help

- 5 What to Know About Legal Fees and Costs

- 6 Summing all up

- 7 Here are some FAQs about Fort Lauderdale property damage lawyer:

- 7.1 How long do you have to file a property damage claim in Florida?

- 7.2 What is considered property damage in Florida?

- 7.3 What are the 4 stages of the insurance claim process?

- 7.4 What kind of damage counts as mischief?

- 7.5 What is the recommended property damage coverage in Florida?

- 7.6 What’s the difference between physical damage and property damage?

- 7.7 How do I speed up a claim process?

- 7.8 How does insurance payout work?

- 7.9 What are the 7 rules of insurance?

When Should You Call a Property Damage Lawyer in Fort Lauderdale?

South Florida property owners face an important choice after damage to their property: Should they handle the insurance claim by themselves or get professional legal help? Their decision’s timing can determine the claim’s outcome. A Fort Lauderdale property damage lawyer can help you get fair compensation instead of financial hardship.

Why early legal help matters

People who get legal help right after property damage receive three times more compensation on average compared to those who wait. About 85% of people who get legal representation in the first week report better compensation outcomes. Lawyers can take several key actions that make this big difference possible.

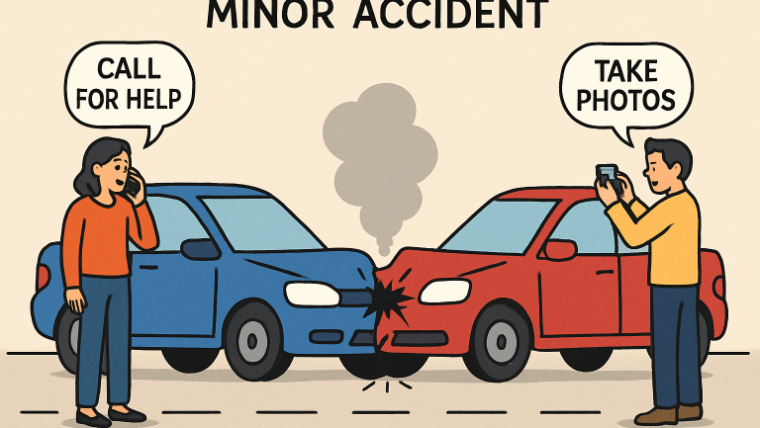

Legal help from the start ensures proper preservation of key evidence. A Fort Lauderdale property damage claim lawyer works with investigators to take photos, get witness statements, and record all important details before they vanish.

Legal assistance early on helps owners avoid making statements that insurance companies might use against them later. Insurance adjusters often take advantage of people who don’t know property damage law to get statements that hurt their claims.

A Fort Lauderdale hurricane property claim lawyer puts it simply: “The first few steps you take after finding property damage can make or break your insurance claim”. This means you need proper documentation and knowledge of your rights before talking to insurers.

What insurance companies hope you don’t know

Insurance companies often try to stop property owners from getting legal help. You should be concerned if an insurer says getting legal help will make claims more complicated or expensive. They want to stop homeowners from learning how to challenge unfair terms.

Insurance companies are businesses that want to maximize profits by paying less for claims. Their adjusters use several tactics to reduce settlements:

- Taking advantage of policy exclusions and complex language

- Saying documentation is not enough

- Slowing down claims without reason

- Making low initial offers

The Insurance Information Institute reports that about 5% of insured homes filed homeowners’ insurance claims in 2021, with 97% of these claims involving property damage. Many Fort Lauderdale property owners don’t realize that insurance companies expect them to accept claim denials without a fight.

How lawyers protect your rights from day one

A Fort Lauderdale property damage lawyer starts protecting your interests right away. They review your insurance policy to help you understand your coverage and rights under Florida law. This review spots potential issues early.

These lawyers handle all talks with insurance representatives. This prevents clients from saying things that might hurt their case. The lawyer acts as a shield between you and insurance companies.

Lawyers who know property damage claims understand what cases are worth and can negotiate effectively with insurance providers. If an insurer denies your claim or offers too little, your lawyer can prepare for court quickly.

A flood damage lawyer in Fort Lauderdale becomes especially helpful with complex claims that have multiple types of damage. They can tell the difference between valid claim denials and illegal insurance company behavior, which ensures fair treatment.

Common Types of Property Damage in Fort Lauderdale

Fort Lauderdale’s location and tropical climate make properties vulnerable to different types of damage throughout the year. Property owners need to prepare for these risks and know exactly when they should get professional legal help.

Hurricane and wind damage

Fort Lauderdale properties face big risks from hurricanes, with wind speeds reaching 140-160 miles per hour. These extreme weather events can destroy properties in several ways. Strong winds can rip roofs off homes, shatter windows, damage siding, and turn everyday objects into dangerous projectiles.

Properties often end up with major structural damage after these storms, and roof damage happens most often. Flying debris creates serious risks to both property and safety, as hurricane-force winds can send objects crashing through windows and tear up roofing materials.

Florida law requires standard homeowners’ insurance policies to cover windstorm damage. All the same, many Fort Lauderdale property damage lawyers say insurance companies often challenge whether wind actually caused the damage, especially when water damage exists too.

Flood and water damage

Standard homeowners’ and commercial property insurance policies in Florida don’t cover flood damage. Property owners need separate flood insurance from either the National Flood Insurance Program (NFIP) or private insurers.

Standard policies should cover water damage that starts inside a home. This covers burst pipes, overflowing bathtubs, or broken appliances. But insurance companies often question where the water damage came from.

Fort Lauderdale property owners often file claims for:

- Water damage from hurricanes or severe storms

- Plumbing problems like leaks or broken pipes

- Sewage system backups

Insurance carriers regularly deny claims by saying water damage happened because of poor maintenance rather than sudden events.

Roof leaks and broken pipes

The coastal climate brings heavy rain, strong winds, and seasonal hurricanes that cause substantial roof damage. NOAA reports show Broward County gets over 60 inches of rainfall yearly, which leads to many moisture-related claims.

Roof leaks often start from storm-damaged shingles, blocked gutters that cause water backup, damaged flashing around chimneys, and old roofs that soak up too much moisture. Most homeowners’ insurance covers roof leaks if they’re caused by covered events like storms or falling objects.

About 10 percent of homes across the country have leaks that waste 90 gallons or more of water daily. Burst pipes can quickly ruin flooring, drywall, furniture, and personal belongings.

Fire, theft, and vandalism

Fire claims usually involve serious damage that affects large parts of the property. Faulty electrical systems and bad wiring cause most residential fires in Fort Lauderdale. Kitchen accidents, unattended candles, smoking materials, and lightning strikes also start many fires.

Homeowners’ insurance usually covers stolen or damaged property in theft cases. Homeowners should list everything that was stolen, report it to police, and document all damage. They need detailed descriptions of stolen items, original receipts, and photos if possible.

Thieves often vandalize properties while stealing, which causes extra damage. Most standard property insurance covers both theft and vandalism, including damage to entry points and interior destruction.

Slab leaks and structural issues

Slab leaks under concrete foundations can seriously damage a home’s foundation, flooring, and plumbing. Poor construction, foundation settling, or pipe wear and tear often cause these leaks.

Most homeowners’ policies cover “sudden and accidental” water damage, including slab leaks. But insurance companies might deny claims if they think the leak happened because of neglect or poor maintenance.

Severe weather in Fort Lauderdale often leads to structural damage. Flood damage lawyers help property owners get compensation for foundation damage after floods. Hurricane property claim lawyers also help with major structural damage claims after big storms.

Why Insurance Companies Deny or Undervalue Claims

Property owners and insurance companies often clash over claims. Insurance companies use several tactics to keep payouts low. Property owners need to know these strategies to protect themselves after their homes or businesses suffer damage.

Policy exclusions and fine print

Insurance contracts have many exclusions that restrict coverage in specific cases. Standard policies don’t cover flood damage. Fort Lauderdale property owners learn this fact too late. Policies also don’t cover wear and tear, neglect, some natural disasters, and damage from poor maintenance.

Insurance companies hide behind complex policy language. They might say “sudden and accidental” water damage doesn’t apply to your case or point to policy limitations. A property damage lawyer in Fort Lauderdale should review your policy before you file a claim to avoid surprises.

Delays in filing or missing documents

Your claim faces denial risks with each passing day. Florida law gives property owners two years to report hurricane claims. Supplemental or reopened claims need filing within one year.

Insurance companies want claims filed “as soon as practicable” after damage happens. They often use small delays as reasons to deny claims. Missing paperwork gives them another excuse to deny claims. They ask for extra documents to make the process harder.

Failure to reduce further damage

Property owners must take steps to stop more damage after the original incident. This means you need to cover a damaged roof with a tarp during the claims process.

Courts support this requirement consistently. The Higginbotham v. New Hampshire Indem. Co. case showed that while insurers must replace wind-damaged roofs, property owners pay for water damage they could have prevented.

Bad faith tactics used by insurers

Insurance companies sometimes use questionable methods to save money. These include:

- Taking too long to process claims or make payments

- Twisting policy terms or coverage details

- Doing poor investigations

- Making substantially low settlement offers

A property damage attorney in Fort Lauderdale spots these unfair practices. Florida lets policyholders file a Civil Remedy Notice with the Department of Financial Services when insurers break fair claims rules.

A flood damage lawyer in Fort Lauderdale helps handle these tricky situations. They know insurance law and understand South Florida property owners’ challenges.

How a Fort Lauderdale Property Damage Lawyer Can Help

Legal experts play a crucial role in helping you deal with property damage insurance claims. A skilled Fort Lauderdale property damage lawyer brings specialized knowledge that helps homeowners and businesses get better outcomes for their claims.

Understanding your policy and rights

Legal professionals take a deep look at insurance policies to spot covered losses and possible exclusions. This detailed review will give you a clear picture of your coverage and legal rights from day one. Your property damage lawyer in Fort Lauderdale can break down complex policy language and help you find coverage you might miss on your own.

Filing and negotiating your claim

Strong documentation makes claims more successful, but most property owners struggle to gather all the needed evidence. Lawyers help collect photos, repair estimates from contractors, material receipts, and records of displacement costs. They also manage all talks with insurance companies so you don’t say anything that could hurt your claim.

Appealing denied or underpaid claims

Insurance companies often try to pay less on valid claims by pointing to preexisting damage or poor maintenance. A flood damage lawyer in Fort Lauderdale can fight back with engineering inspections, weather records, and witness statements. When claims get denied, lawyers can take your case to Florida’s Department of Financial Services or start legal action.

Maximizing your settlement

Lawyers use their standing with insurance companies to get fair compensation through negotiations before lawsuits. They can file breach of contract and bad faith lawsuits against difficult insurers when needed. Florida Statute §627.428 lets policyholders who win against their insurer recover reasonable attorney’s fees. This makes legal help available even for complex property damage cases.

What to Know About Legal Fees and Costs

Property owners often hesitate to get significant legal help after disasters because they worry about costs. Money problems should not stop anyone from getting the compensation they deserve.

Contingency fee structure explained

Fort Lauderdale’s property damage lawyers work on contingency fees, which means no upfront costs. Lawyers typically receive 33⅓% of recovered amounts for cases settled before litigation and 40% after filing lawsuits. Their compensation relates directly to yours, which helps encourage engagement to maximize your settlement. Professional legal associations monitor these agreements to ensure clients receive fair treatment throughout the process.

When the insurer pays your legal fees

Florida Statute 627.428 required insurance companies to pay policyholders’ legal fees for court victories until 2023—even for small recoveries. The “one-way fee” rule no longer exists, but you still have options to recover legal costs. Offers of Judgment (§768.79) can make insurers pay fees if your trial recovery beats your settlement offer by 25%. Some policies and leases include fee reimbursement clauses worth checking.

No recovery, no fee: what it means

This simple principle means exactly what you think—you pay nothing unless your attorney wins compensation. You won’t pay consultation fees, investigation costs, or charges for paperwork and negotiations. Property damage attorneys share the financial risk with their clients, which creates shared interests focused on getting maximum compensation.

Summing all up

Property damage claims create many challenges for Fort Lauderdale homeowners and business owners. Insurance companies use tactics to minimize payouts, and property owners struggle to recover their losses. Everything in handling property damage claims in South Florida depends on understanding these strategies.

Legal help in the first week is the key to a successful claim. Property owners with early legal representation receive three times more compensation than those who handle claims on their own. Fort Lauderdale property damage lawyers protect their clients by preserving evidence, handling communications, and preventing statements that could hurt their claims.

Insurance companies know that policyholders rarely understand their policies’ complex exclusions and requirements. Many homeowners find out too late that standard policies don’t cover flood damage after hurricanes or severe storms. It also denies claims when property owners delay reporting, miss documents, or fail to alleviate further damage.

Legal help is available to anyone with property damage problems because most Fort Lauderdale property damage attorneys work on contingency fees. Their “no recovery, no fee” structure means clients only pay when their lawyer wins compensation.

Hiring a Fort Lauderdale hurricane property claim lawyer or flood damage attorney ended up making the difference between fair compensation and financial hardship. Note that when insurance companies discourage legal help, you should question their motives. Insurance providers are profit-driven businesses that want to keep settlements low.

Property owners should ask a qualified property damage lawyer before accepting any insurance settlement offer. This simple step could mean the difference between getting full compensation and settling for nowhere near the actual damage value.

Here are some FAQs about Fort Lauderdale property damage lawyer:

How long do you have to file a property damage claim in Florida?

The statute of limitations to file a property damage lawsuit in Florida is typically four years from the date of the incident. It is crucial to consult with a property damage lawyer in Fort Lauderdale immediately to ensure all paperwork and evidence are submitted well before this deadline expires to protect your right to compensation.

What is considered property damage in Florida?

Property damage in Florida encompasses harm to physical structures, both residential and commercial, as well as to personal belongings inside. This includes damage from events like fires, water leaks, storms, or vandalism, and a commercial property damage lawyer in Fort Lauderdale can help assess if your business’s losses qualify under this definition.

What are the 4 stages of the insurance claim process?

The four main stages are reporting the claim, the investigation and documentation phase, the evaluation and negotiation of the settlement offer, and finally the payout. A fort lauderdale property damage claim lawyer can guide you through each step, ensuring proper documentation is submitted to support your case for a full and fair settlement.

What kind of damage counts as mischief?

Mischief, often referred to as vandalism, involves willful, malicious, or reckless destruction or defacement of another person’s property. This can include acts like graffiti, broken windows, or slashed tires, and pursuing compensation for such intentional acts is a common reason to hire a property damage lawyer in Fort Lauderdale.

What is the recommended property damage coverage in Florida?

While Florida law requires property damage liability coverage for auto insurance, for property owners, securing comprehensive coverage is highly recommended. Consulting with a property damage lawyer in Fort Lauderdale can provide clarity on the optimal coverage limits for your specific home or business to protect against unforeseen events like storms or theft.

What’s the difference between physical damage and property damage?

In insurance contexts, “physical damage” often specifically refers to damage to a vehicle, such as coverage from a collision. “Property damage” is a broader term that refers to damage to any type of property, including buildings and land, which is the primary focus of a commercial property damage lawyer in Fort Lauderdale.

How do I speed up a claim process?

You can speed up the process by reporting the claim immediately, providing thorough documentation like photos and videos, and maintaining detailed records of all communications. Hiring a fort lauderdale property damage claim lawyer can significantly expedite the process as they understand how to effectively pressure insurers and navigate complex procedures efficiently.

How does insurance payout work?

After a claim is approved, the insurance company will issue a payout, typically in the form of a check or direct deposit, minus any applicable deductible. The amount is based on the policy’s terms and the assessed value of the damage, which is why having a property damage lawyer in Fort Lauderdale to negotiate can ensure you receive the maximum settlement you are entitled to.

What are the 7 rules of insurance?

While not a formal list, core principles include utmost good faith, indemnity, insurable interest, proximate cause, subrogation, contribution, and loss minimization. A skilled property damage lawyer in Fort Lauderdale uses these principles to hold insurance companies accountable to their policy agreements and to fight for a fair outcome on your behalf.