Building a financial legacy that stands the test of time isn’t just about accumulating and distributing money. It’s about making deliberate choices that reflect your family’s core values, expectations, and aspirations. Modern families navigating generational wealth planning face evolving challenges, from complex family structures to dynamic tax laws. To ensure your wealth endures, it is essential to adopt a strategic and holistic approach. For individuals seeking guidance tailored to their specific circumstances, options such as investment services near me can help develop effective, long-term strategies.

Wealth transfer is no longer a simple handoff; it’s a multi-generational conversation that blends financial literacy, family governance, and changing societal expectations. By integrating technical tools, such as trusts, with robust education and professional support, you can empower the next generation to be prudent stewards of your legacy.

Table of Contents

Defining Family Values and Mission

The cornerstone of successful wealth planning isn’t the investments or structures—it’s the shared commitment to a set of guiding values. Start by developing a family mission statement that captures what matters most, whether it’s philanthropy, entrepreneurship, education, or family wellness. This mission helps every generation make aligned decisions and sets a standard for family behavior and financial priorities. According to CNBC, families with a firm sense of mission are better able to weather both economic changes and interpersonal challenges.

Involving all key family members in creating this statement, particularly next-generation heirs, increases buy-in and makes it a living document that guides everything from investments to charitable work. Defining roles and responsibilities early ensures that everyone understands both their privileges and obligations.

Open Communication and Regular Meetings

Transparent, ongoing dialogue is an often-overlooked but critical part of any successful wealth plan. Regular meetings, whether annual retreats or quarterly virtual check-ins, allow family members to air concerns, learn about current assets, and revisit goals as situations and priorities change. These touchpoints help avoid miscommunication and can diffuse tensions that often lead to costly legal disputes later. As CNBC highlights, families who discuss financial topics openly tend to have children who are far better prepared to manage wealth and make informed choices.

Utilizing Trusts and Financial Instruments

Legal structures like dynasty trusts provide a long-term framework for asset protection and tax efficiency. A dynasty trust, in particular, is designed to last for generations, shielding wealth from estate taxes and creditors and ensuring assets are distributed according to your family’s specific rules. Other vehicles to consider include family limited partnerships or charitable foundations, tailored to your family’s mission and legacy.

Educating Heirs on Financial Responsibility

The best legal documents are ineffective if future generations aren’t prepared for their roles. Begin basic financial education early, focusing on budgeting, investing, and the underlying philosophy of stewardship. As heirs grow older, please encourage them to manage their own small investment accounts or get involved in family philanthropy. These hands-on experiences are far more effective than theoretical discussions.

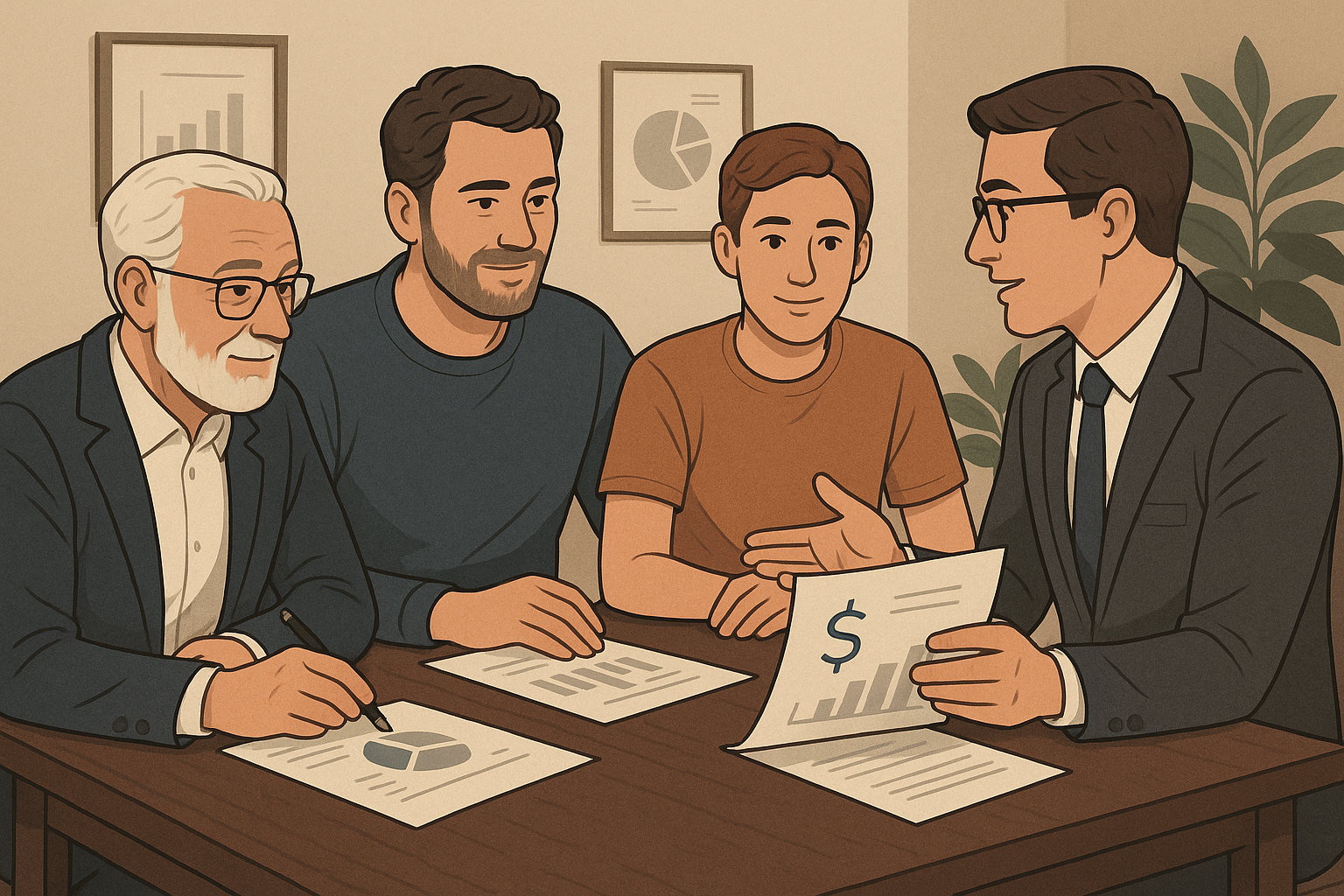

Engaging Professional Advisors

Even the most savvy DIY investor can benefit from external expertise. Financial advisors, estate attorneys, and tax specialists keep your strategy current and compliant as laws and financial landscapes shift. Advisors serve as neutral third parties, helping facilitate family meetings, mediate disputes, and guide major decisions such as business succession or major philanthropic commitments.

Implementing a Family Bank Concept

Rather than leaving heirs with a lump-sum inheritance, some of America’s most successful families use the Family Bank concept. This strategy allows family members to borrow against the family bank for meaningful projects: higher education, starting a business, or buying a first home. Each loan follows set criteria, which promote accountability and ensure the family’s collective assets are used wisely. This method creates an ongoing legacy while teaching heirs to manage debt and responsibility—skills that extend to other areas of their financial lives.

Addressing the Great Wealth Transfer

Over the next two decades, baby boomers will transfer an unprecedented $84.4 trillion to the next generations, making proactive planning more urgent than ever. Understanding your family’s unique challenges, from blended families to cross-border assets, is critical. Developing a holistic strategy to address tax implications and potential conflicts lays a strong foundation for both the present and the future.