Table of Contents

What Are Order Blocks?

Order blocks are foundational zones on financial charts where significant institutional buying or selling has previously taken place. Experienced market participants closely watch these clusters because they often mark the opening shots in large-scale moves. Understanding where these clusters form gives traders a significant advantage, enabling them to anticipate price activity instead of following it. Learning the principles behind order block trading helps demystify institutional moves and makes such strategies accessible to retail traders. Unlike simple support and resistance, order blocks reflect supply and demand imbalances caused by big players entering or exiting the market. Traders who can locate these hot zones on a chart essentially see where banks or hedge funds previously took strong positions. This knowledge empowers individuals to position themselves ahead of price moves, taking advantage of momentum shifts before they become apparent to the majority.

Why Traders Value Order Blocks

Seasoned traders value order blocks because they offer rare transparency into institutional market behavior. While retail volume helps grease the wheels, the immense size of institutional orders truly drives trends and reversals. These orders typically cluster at specific price points, revealing the likely areas of support and resistance well before they play out publicly. By keying into these levels, traders enhance their strategic playbook, enabling sharper entries and exits. Additionally, order blocks add a crucial layer of logical reasoning to technical analysis. Unlike many lagging indicators, they provide tangible evidence of potent activity. This can give traders confidence in their analysis, particularly in volatile markets where traditional indicators may give mixed signals. The clarity that order blocks bring can help filter out emotional decision-making, a common downfall in fast-paced markets.

Identifying Order Blocks On A Chart

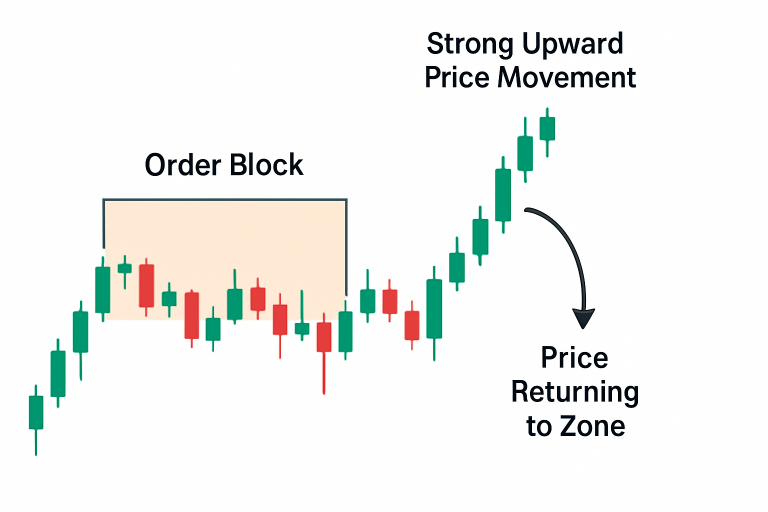

Spotting order blocks requires a blend of observational skill and technical know-how. The most common signature is a period of sideways consolidation followed by an explosive breakout in price or a noticeable volume surge. The base of this move—the actual range from which price launches upward or downward—usually marks the order block. Traders typically draw a zone covering the consolidation as their reference area. Visual cues are key: look for elongated candles or bodied price bars that burst from a tight range. A subsequent retest of this origin area, especially when the price quickly rebounds, often confirms that institutions are defending their previous positions. Mastering this skill can take time, but it transforms raw price data into actionable information, especially when combined with volume analysis or price action cues.

Real-Life Examples Of Order Block Trading

Consider a forex trader analyzing EUR/USD: after observing a week-long period of consolidation, a sharp upward surge occurs. By marking the lowest point of this sideways consolidation as an order block, the trader watches for the price to return to this zone. When it does, price rebounds—an institutional footprint in action. In the stock market, examples abound. The Tesla rally in 2020 featured several moments where the price surged from consolidation, later retracing to those very zones before launching again. These moments offered reliable roadmap markers for savvy order block traders.

Benefits Of Order Block Trading Strategies

- Improved Entry and Exit Points: By identifying precise zones of institutional interest, traders find cleaner entries and more strategic exits.

- Better Risk Management: Stop-losses can be placed just beyond the block, minimizing loss if the institutional activity fails to hold.

- Increased Confidence: Watching smart money at work provides conviction, particularly in turbulent or trendless markets.

Challenges And Risks To Watch For

Despite their power, order block zones aren’t infallible. Markets can and do break previously respected blocks, resulting in what’s known as false breakouts. These moves can trap unsuspecting traders. Drawing blocks must also be done carefully—misidentifying ranges or acting on blocks visible to everyone can make traders targets for predatory algorithms. To mitigate these risks, patience and disciplined trade confirmation are key. Leveraging additional tools like volume or candlestick confirmation can help manage risk and filter out false signals.

Combining Order Blocks With Other Analysis

Order block strategies reach their full potential when integrated with other analytical techniques. Many successful traders combine block identification with classic tools such as RSI, MACD, or moving averages to confirm trend strength or reversal potential. For example, if the RSI indicates an oversold condition as price returns to a bullish order block, it strengthens the case for a reversal or continuation. Monitoring relevant economic news, such as earnings releases or central bank announcements, gives context to price action around order blocks. Using a multi-layered approach, traders balance the precision of order blocks with broader market awareness, helping sidestep the risk of over-reliance on a single strategy.

Conclusion

Order block trading gives traders a powerful lens into institutional market behavior, transforming complex price action into actionable opportunities. By identifying these zones of concentrated buying or selling, traders gain clearer insight into where momentum will shift, improving precision and confidence in their strategies. While order blocks are not without risks—such as false breakouts or misidentification—combining them with other technical tools and sound risk management greatly enhances their effectiveness. Mastering order block analysis equips traders with a structured, data-driven approach that balances technical insight with practical application. For those willing to invest the time and discipline, order block trading can become a cornerstone in navigating today’s fast-moving markets.